OPINION - Over any 6-month, 1-year, 2-year, 3-year, and 5-year period, financial markets will typically be up. The longer the time frame, the higher the probability of a positive outcome.

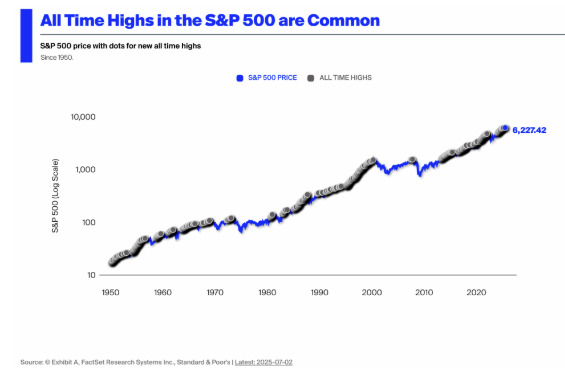

What’s interesting is that trend also applies when markets are at all time highs, like we are seeing now - locally in the JSE, and offshore in the US markets (the S&P 500).

New market highs are a feature of a growing economy.

For example, since 1990, the S&P 500 has hit a new all-time high roughly 20 times per year on average.

It’s what markets are supposed to do over time. They go up.

I found this chart from a blog I follow about all time highs in the US market.

It’s a nice way of looking at it – see how they tend to cluster together?

Source: https://awealthofcommonsense.com/2025/07/investing-a-lump-sum-at-all-time-highs-2/

Source: https://awealthofcommonsense.com/2025/07/investing-a-lump-sum-at-all-time-highs-2/

I made a similar chart for the JSE going back to 2009.

Chart: JSE All Share Index

Chart: JSE All Share Index

See all those red dots? They cluster, just like in the chart with the S&P.

Of course, we had that dead patch between 2015 and 2020 — those were tough times. Over that stretch, cash actually outperformed our equity market. But if you managed to hold your head, you were well rewarded – an annualised rate of 15% over the next 5 years.

The bad news is that the highs don’t arrive in a straight line. There can be extended periods where it feels like nothing is happening, or worse — you are losing money.

But I don’t like to be negative, so let’s be positive.

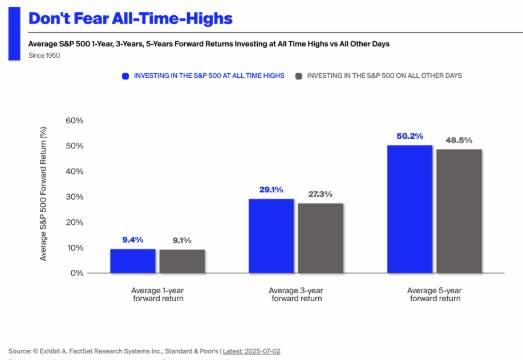

Here’s another chart on the S&P 500 — this one shows the returns you’d get if you only invested on days when the market was hitting all-time highs, compared to investing on all other days.

Source: https://awealthofcommonsense.com/2025/07/investing-a-lump-sum-at-all-time-highs-2/

Source: https://awealthofcommonsense.com/2025/07/investing-a-lump-sum-at-all-time-highs-2/

It’s fascinating – it shows your returns are actually better when investing at all-time highs. It’s counterintuitive. You wouldn’t think that was the case.

In other words, there’s no reason to fear investing at market highs. Statistically, the odds are on your side. The lesson is that we need to be comfortable that buying at a high is just part of the process.

Of course, we’re human, and we’re not wired to be purely rational. Losses tend to hurt more than gains feel good. The regret of putting in a lump sum right before a drop is real.

If holding a bit more cash helps you sleep at night, even if it means missing out on some upside, then that’s probably the right approach for you.

I’ve said it before — the biggest risk in investing isn’t the market, it’s your own behaviour.

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’