BUSINESS NEWS - StatsSA has released some better-than-expected Gross Domestic Product (GDP) numbers for the South African economy earlier this week. Our economy has grown 1.6% over the past year.

While this number was better than expected, I would note our economy as a whole is still slightly smaller than pre-Covid, as the chart below illustrates.

In fact, our economy has hardly grown since 2016. If we add up total growth since then, it comes in at below 5%.

The start of this period was marked by Zuma's disastrous firing of Nene as our Finance Minister in December 2015. This was followed by Des van Rooyen's 4-day tenure as the new Minister, or as the media nicknamed him, 'the weekend special.'

Not surprisingly, South African asset prices have stagnated since then. Property prices have been flat or negative across the country (unless you live in the Western Cape). I'm still trying to sell my house in Joburg.

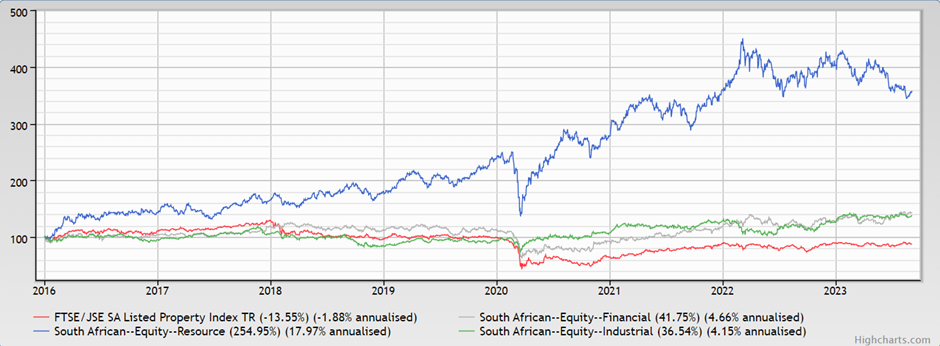

Property and financials are often taken as a proxy for SA Incorporated (companies that derive the bulk of their earnings from inside South Africa and, therefore, reflect the reality on the ground, i.e., load shedding, poor infrastructure, over-regulation, etc.). Looking at the chart below, these sectors haven't even kept up with inflation. You've lost money in real terms over these past 7 years.

Thank goodness for the resource sector and companies like Anglo and BHP. They've delivered a healthy 18% per annum over the same period.

This has been the saving grace for the JSE All Share Index, which delivered an annualized 8.8% over this period.

We are fortunate to have such big hitters listed on the JSE. I would also include Richemont and Naspers. Richemont is up 107%, while Naspers is up 67% over the same period.

All the highfliers in our market earn almost 100% of their income from outside our borders (this is why we call them rand hedges) and are therefore not as impacted by domestic issues.

Not surprisingly, SA Inc companies are currently trading at low valuations. But they're cheap for a reason.

Until we see an improvement in our economic growth numbers, which, in turn, is not going to change until we see major improvements to Eskom (among other things), they are going to remain cheap and likely continue to lose value in real terms.

I see we are back to stage 6 load shedding. The new Minister of Electricity is clearly off to a bad start. I remain optimistic about our long-term future, but in the near term, our economic outlook is not so great.

Be thankful for your inverter.

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’