MOTORING NEWS - The global automotive market presents a mixed outlook, with trends that underscore both emerging challenges and opportunities. Considering the international stage, the industry is grappling with a range of factors impacting both production and sales.

The COVID-19 pandemic and, consequently, supply chain disruptions have left an indelible mark, causing semiconductor shortages and driving up production costs.

Additionally, fluctuations in regional economies and shifting policies on emissions and sustainability are significantly shaping the industry's future.

Amidst these uncertainties, some markets are showing signs of recovery and adaptability. Notably, the South African automotive market is experiencing a pivotal moment, with recent data revealing moderate growth in domestic sales, yet a considerable challenge in the export sector.

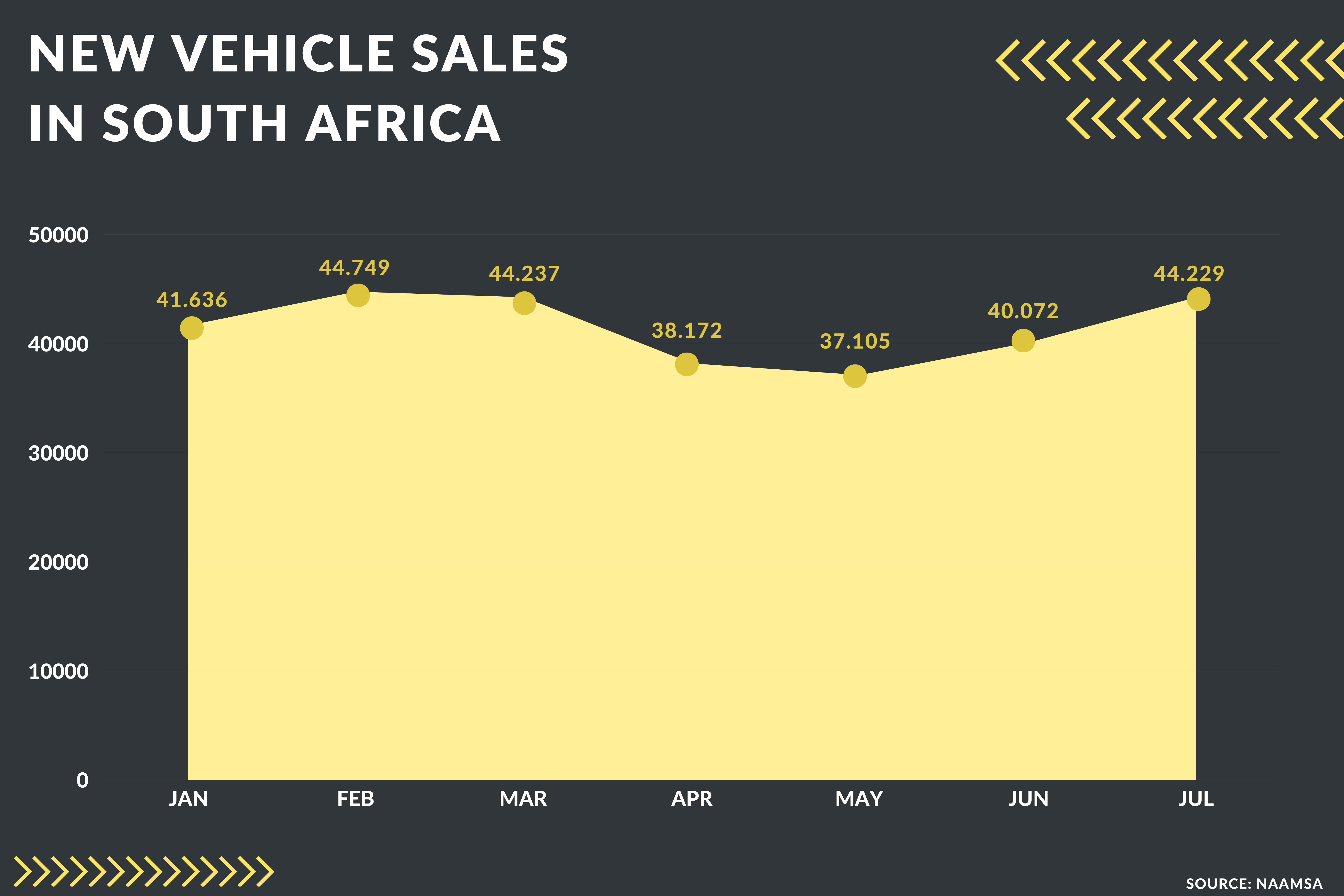

In July 2024, South Africa witnessed a slight increase in new vehicle sales, with a 1.5% rise compared to the same period last year, according to Naamsa. Sales reached a total of 44,229 units, indicating a partial recovery after months of fluctuating performance.

When analyzed in detail, the passenger vehicle segment saw a positive performance, with 29,934 units sold in July, representing a 6.8% increase compared to the same month in 2023.

This growth can be partially attributed to seasonal sales boosts and a rising demand for new vehicles among South African consumers. Meanwhile, car rental sales also made a significant contribution, accounting for a solid 17.1% during the month.

However, the light commercial vehicle, new pick-up truck, and minibus sectors faced difficulties, with an 8.8% year-on-year sales decline, totalling 11,554 units. This drop is partly due to the phasing out of the popular Nissan NP200, which had contributed to last year’s figures. In this context, the car insurance sector also faced a negative outlook, as lower sales affected the demand for insurance for these specific models.

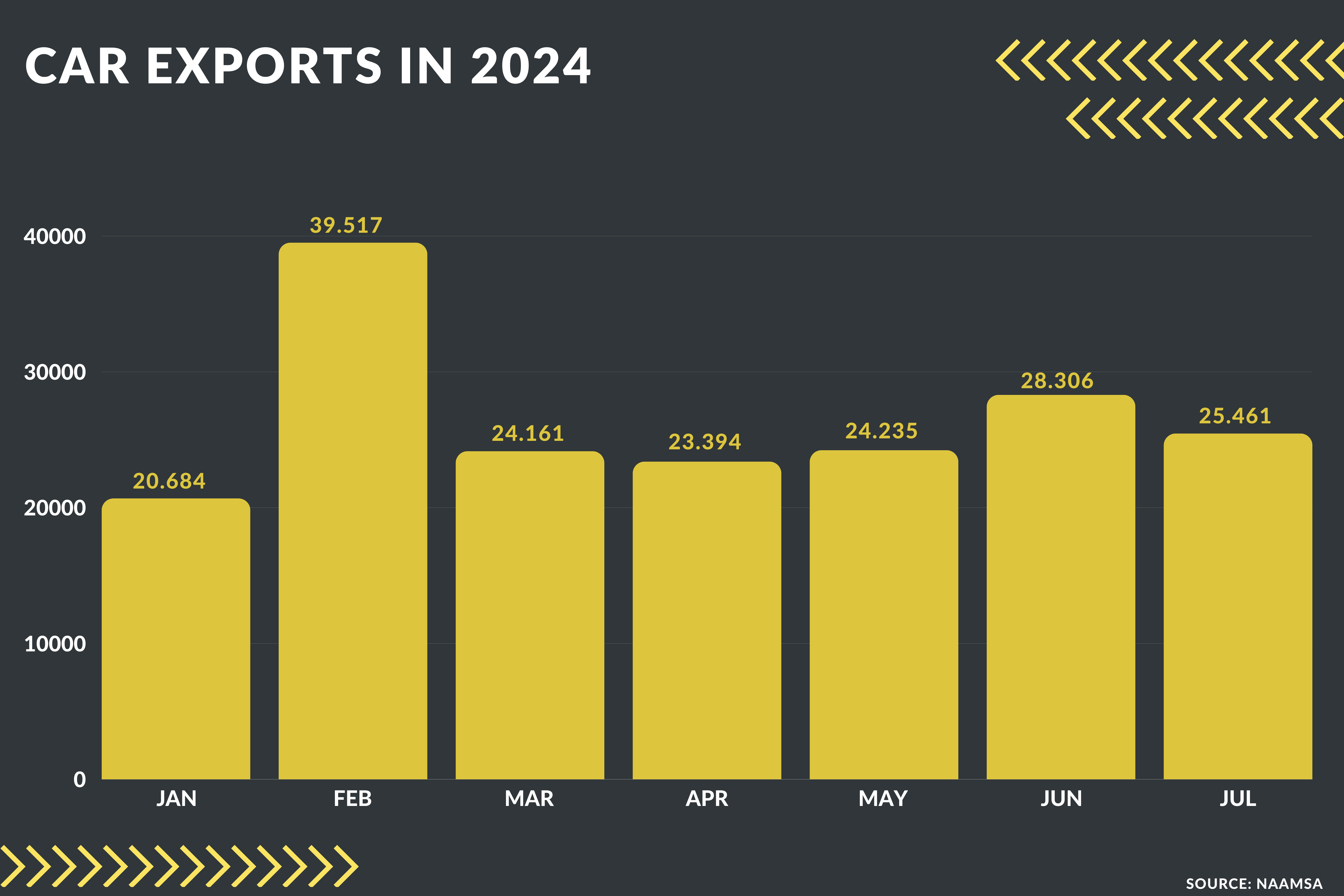

The most concerning aspect for the country’s automotive industry is the performance in the export market. In the seventh month of the year, vehicle exports plummeted by 33.2%, with only 25,461 units exported compared to 38,132 units in the same month last year.

Cumulative exports for the first seven months of the year have decreased by 13.5% compared to the same period last year. According to Naamsa, this decline is attributed to several factors, including adverse weather conditions and a decrease in demand from Europe, which remains the primary export market.

The economic slowdown in Europe, where the Eurozone GDP grew by just 0.3% in the second quarter of 2024 and Germany’s GDP contracted by 0.1%, has negatively impacted South African exports.

Despite these challenges, some vehicle models have maintained a crucial role in the export portfolio. The Mercedes-Benz C-Class, with 7,400 units exported in July, remained the country’s leading export product. Other notable models included the BMW X3, Ford Ranger, and Volkswagen Polo.

However, the Volkswagen Polo has seen a significant decline in recent months, though it is expected that the Kariega plant in the Eastern Cape, which will become the sole global supplier of the Polo hatchback, may stabilize this downward trend.

It is worth noting that the Mercedes-Benz C-Class has also faced a reduction in global demand, leading the company to announce a reduction in its workforce by 700 employees to cope with the declining international demand, reflecting the issues faced by automakers in an uncertain economic environment.

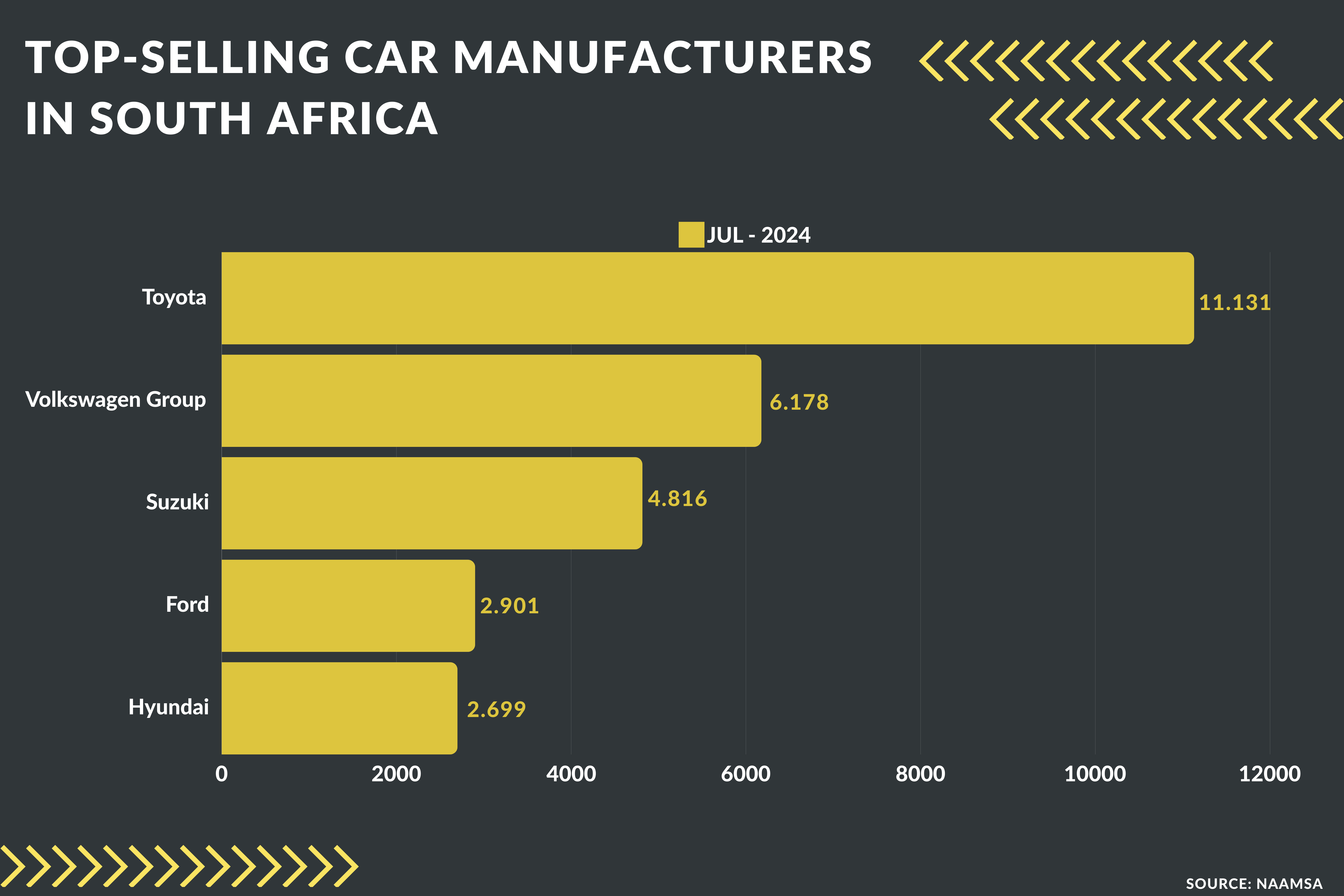

Nevertheless, despite the drop in exports, some manufacturers have achieved improvements in the domestic market. Toyota, for instance, led the market in July with a total of 11,131 units sold, representing a 14.2% month-on-month increase.

The Volkswagen Group, with 6,178 units, had an outstanding performance, marking its best sales month of the year to date. Other brands, such as Ford and Hyundai, also achieved their best results of the year in July.

Outlook for remaining 2024

The South African export market presents a mixed outlook for the remainder of 2024. While there is a decline in new vehicle sales compared to last year, Naamsa and the Automotive Business Council maintain an optimistic view, based on factors such as the absence of supply chain disruptions for four consecutive months, a stronger rand, and the possibility of interest rate cuts before the end of the year.

Last year, South Africa exported a record of just over 396,000 vehicles. Although this figure is modest on a global scale, it represents a significant contribution to the country’s manufacturing output and GDP.

Since 2014, exports have grown by 20%, and it is projected that they will increase by 6% this year, reaching approximately 420,000 units.

This growth is partly due to incentive programs such as the Motor Industry Development Programme (MIDP) and the Automotive Production and Development Programme (APDP), which have transformed the industry since the apartheid era.

The free trade agreement with the European Union and duty-free access to the U.S. through the African Growth and Opportunity Act (AGOA) have been crucial to the success of South African exports.

Today, about two-thirds of the vehicles produced in the country are exported, with Europe and the United Kingdom absorbing nearly half of the production.

However, the future of the South African automotive industry is at stake. The European Union and the United Kingdom plan to ban the sale of internal combustion vehicles by 2035. To maintain its competitiveness, it is imperative that South Africa begins manufacturing electric vehicles.

In fact, the government announced incentives for electric vehicle production starting in 2026, but incentives for local buyers will only apply later in the decade.

Leading brands such as BMW and Mercedes could spearhead the transition to electric cars, although there are no definitive announcements yet. On the other hand, Volkswagen has indicated that it does not plan to produce electric models in South Africa until there is a significant local market.

Meanwhile, VWSA’s Kariega plant, which has been a pillar in Polo exports, also faces future uncertainties due to the possible discontinuation of the model towards the end of the decade.

Thus, South Africa navigates an uncertain economic environment, seeking ways to adapt and seize opportunities for growth.

‘We bring you the latest Garden Route, Hessequa, Karoo news’