COLUMN - One of the big questions for this year is whether the US will go into a recession or not.

You may have heard pundits talking about whether there will be a soft or hard landing – this is what they are talking about.

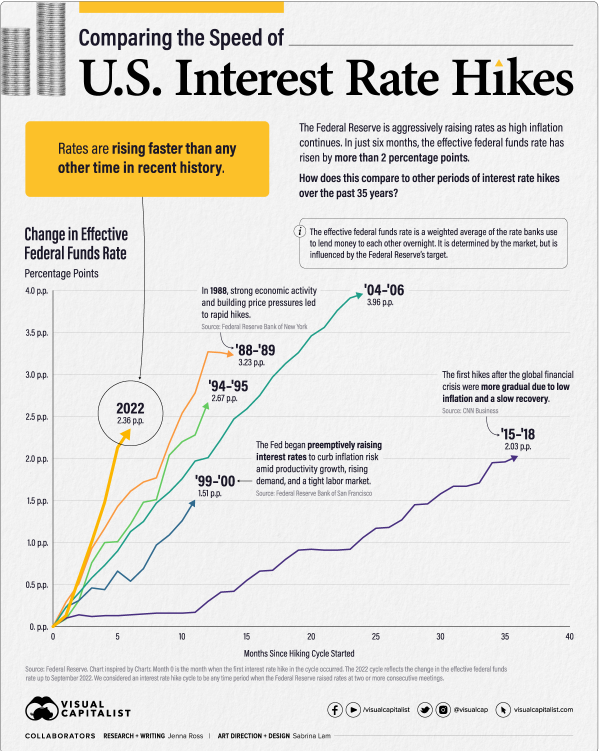

The interest rate hikes of 2022 to combat rising inflation were the sharpest we have seen in over 100 years.

The Fed initially thought inflation was transitory, but when it stuck around for longer than anticipated, they acted in haste and played “catch-up”.

We saw the immediate reaction to interest rate hikes from the market – 2022 was the 7th worst year for the S&P since the Great Depression in 1930. However, the US economy seemed unfased and continued to add jobs. Remember, the market and the economy are not the same thing.

At present, we see several indicators pointing to recession.

The chart below shows the Purchasing Managers Index (PMI), which summarizes economic activity in the manufacturing sector. The chart shows a dramatic decrease in activity from the highs of late 2021 before rates were hiked.

US ISM manufacturing Data

The chart below shows US existing home sales numbers at levels close to and even below pre-COVID levels. Clearly, higher interest rates have impacted affordability.

Source: Institute of Supply Management; Stanlib Webinar

Source: Institute of Supply Management; Stanlib Webinar

US existing home sales

Source: National Association of Realtors; Stanlib Webinar

Source: National Association of Realtors; Stanlib Webinar

Finally, the US consumer confidence indicator is below where it was during the financial crisis of 2008. We’ve seen US retail sales data coming out earlier this year indicating lower sales numbers and a weaker consumer.

US consumer confidence (University of Michigan)

Source: University of Michigan

Source: University of Michigan

While none of these indicators are themselves the US economy, they are all key data points which point to a negative outlook and likely recession.

So, why are markets so positive and why are there a host of Wall Street analysts predicting a soft landing?

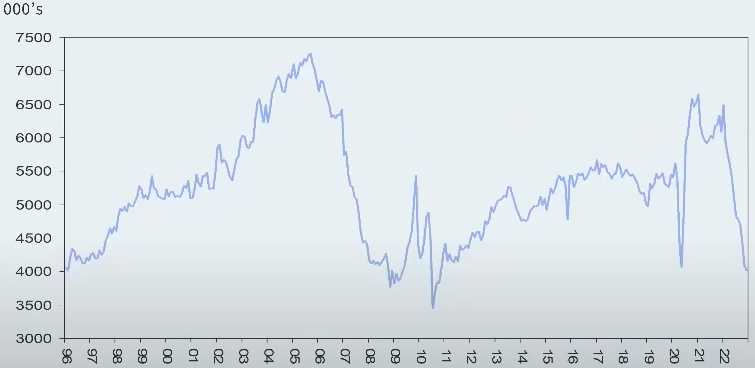

Well, how can there be a recession when the economy is at close to full employment?

The chart below shows US employment at the highest it has ever been.

United States employment

Source: United States Bureau of Labor Statistics

Source: United States Bureau of Labor Statistics

So, we have these two contradictory data stories. One tells us that a US recession is imminent, and the other tells us the economy is close to full employment.

The US economy needs time to digest the rate hikes. It typically takes about 12 months before the first effects are felt. If this leads to lower earnings from companies, less investment because funding is too expensive, and a lull in the housing market, we could see job losses next. And the market will react negatively to any of this news.

Of course, this has big implications for South Africa. A US recession impacts global investment sentiment – investors pull money out of risky assets like those in emerging markets. We are an emerging market.

As always, there is a lot of uncertainty in the market. There always has been and there always will be.

My advice – don’t try to predict. Stick to your strategy. A well-designed portfolio will weather the storm. Invest in growth assets with your long-term money and bonds and cash for short term needs. Keep it simple.

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’