COLUMN - Last year was a bad year for investments. The MSCI World Index was down just over 17% in USD!

They say diversification is the only free lunch when it comes to investing. This is because historically, different asset classes move in different directions under different market conditions.

All that means is when one asset class goes down, there is usually another that goes up to offset it. An example would be the relationship between stocks and bonds – typically, stocks fall when bonds rise, and stocks rise when bonds fall.

But this wasn't the case in 2022. Everything fell.

Chart: MSCI World Index

Chart: MSCI World Index

The spike in inflation early in 2022 prompted central banks to embark on one of the most rapid rate hike cycles in history, leading to declines across all asset classes, including bonds, stocks, and property. Diversification didn't work in 2022.

I bring this up following a podcast I recently listened to featuring several prominent local asset managers discussing their outlook for the future. They reached a similar conclusion about 2022; however, they stressed that there are always opportunities, even in down markets.

They came up with several examples of how one could have generated a handsome return in 2022:

- Shorting duration in the bond market

- Betting big on the energy sector

- Investing in China from August 2022 (China saw a 40% return in just two months)

The underlying message was that even in challenging market environments, opportunities exist.

While I agree with this, I couldn't help but wonder how many of these managers actually took these bets, and if they did, what other bets they made and how these turned out.

Moreover, is it really worth it to make these kinds of bets to avoid a single year of negative returns?

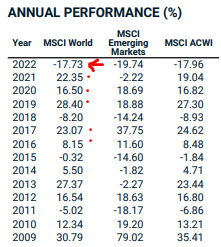

Have a look at the table below – it shows the returns of the MSCI World Index for individual years (second column) –

Source: MSCI

Source: MSCI

We see the MSCI World Index declined 17.73% in USD in 2022, as per the initial chart. That's tough.

But look at the three preceding years – 28.4%, 16.5%, 22.35% - all in USD.

2018 saw a decline of 8.2%, but before that, the market was up 23% and 8.1%.

My question again – is it worth taking risky bets to avoid a single bad year?

While short-term market fluctuations are unnerving, history has shown that remaining invested and weathering the storm often leads to favourable outcomes. While there is always opportunity in bad years, as the market experts point out, it may not be worth trying to outmanoeuvre the market. Even Buffett has admitted to getting it wrong.

My advice – keep it simple and stick to your investment strategy. A well-designed portfolio will weather any storm.

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’