Sponsored Content

BUSINESS NEWS - A successful second information session was hosted in February for prospective buyers in the Mountain View development's First Home Finance section. The first of these sessions was held in December.

Lindilizwi Mngxekeza from the Mossel Bay Municipality (manager integrated human settlements) addressed the meeting and provided an introduction to the development.

Gavin Wiseman, the director for affordable housing from the chief directorate: human settlements planning of the Department of Infrastructure travelled from Cape Town specifically to address questions raised at the information sessions.

He explained the structure of the development, as specified by national government. Wiseman made reference to the National Housing Policy and the availability of some 725 Breaking New Ground, free housing units, that provides housing to +/- 2 900 individuals, in relation to the 278 units that have been made available to be purchased by first time buyers, who earn between R12 000 - R22 000 per month.

Meyer de Waal and Vusi Gxelesha of Meyer De Waal Incorporated with Gavin Wiseman, the Director for Affordable Housing from the Chief Directorate: Human Settlements Planning, Department of Infrastructure, Western Cape Government and Lindilizwi Mngxekeza from the Mossel Bay Municipality (Manager Integrated Human Settlements) at the information session.

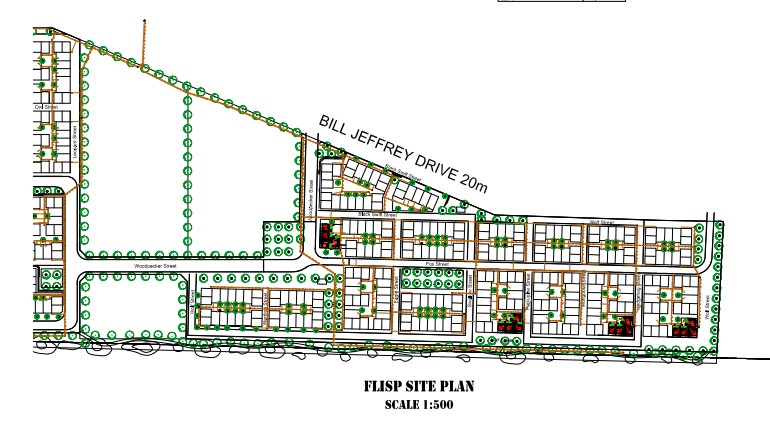

The First Home Finance units are separated from the free units by a section of land and also differs when it comes to design and features.

The First Home Finance units, formerly known as FLISP units are separated from the Breaking New Ground units by a section of land.

Subsidies

An important note made was that the first-time home buyers can make use of the First Home Finance Subsidies to reduce the purchase price of the units sold. All transfer and bond costs are included.

Meyer de Waal and Vusi Gxelesha of Meyer De Waal Incorporated completed the presentations with a 61-page Power Point presentation, which focused on how to determine the First Home Finance Subsidy one can qualify for; how to get oneself ready to apply for property finance and/or any type of de-linked finance to qualify for a subsidy; what impact a low, bad or good credit score will have on any type of property finance and further considerations.

Local attorney Fiona Williamson of Fiona Law assisted with enquiries.

Gavin Wiseman addresses concerns expressed by prospective home owners.

Questions raised at the sessions included what the minimum income earned must be, what will happen to those who earn under R12 000 per month, what can be done to improve a credit score, can a house be bought by someone currently under debt review, and how to view the show unit.

Some aspiring homeowners attended the workshop to establish the reasons why they cannot receive the housing units being sold for R429 000 for free. Wiseman was able to address these issues and answer all questions. Many first-time buyers are experiencing issues regarding the capacity to secure a home loan, thereby meeting the requirements for First Home Finance, and may be hindered by challenges related to credit scores problems and affordability.

Interested buyers were invited to visit the furnished show unit as well as the 10 other show units available for viewing immediately after the sessions.

Potential buyers were impressed with the show units as well as the furnished show unit.

For any further information or to watch the video of the showhouse, visit www.mountainviewmosselbay.co.za/.

More information can also be found here: www.attorneyrealtorhub.co.za/property-for-sale-in-de-almeida-s10466 or contact Meyer de Waal, head, sales and marketing, MDW INC Property Sales (meyer@mdwinc.co.za or 083 653 6975 or 021 461 0065).

‘We bring you the latest Garden Route, Hessequa, Karoo news’