For those of you who follow the JSE All Share Index, you may have noticed it broke through the 100,000 level a week ago.

This is a momentous occasion — the index briefly dipped below 40,000 during the COVID crash in 2020, and as of writing, now sits just over 102,000.

That’s a 155% increase in just over five years. Of course, no one I know allocated their entire portfolio at that exact point.

Back then, we were analysing the Spanish Flu of 1918, wondering whether we’d ever come out of lockdown, and futurists were declaring the world had changed forever.

And yet, today most businesses require staff to be back in the office five days a week. The world didn’t stay changed for long. Like most crashes, we found our way out, and life returned to normal.

I suspect the next crash will feel the same. Each one is different, and in the moment feels like the end of the world. But then it isn’t — and life carries on.

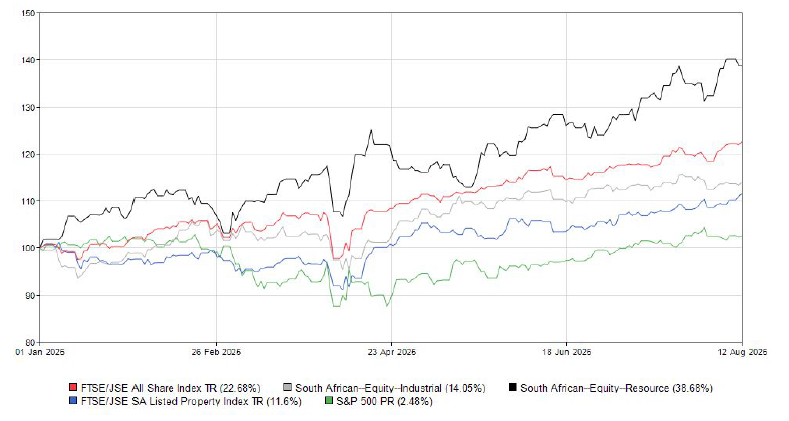

Here’s a chart of the JSE’s performance this year so far:

The index is up just over 22% year-to-date. The rand has also strengthened from R18.82 to R17.50 to the US dollar. If Americans had moved their dollars into the JSE on 1 January 2025, they’d now be up about 30% in USD terms. Not bad.

Interestingly, it’s been our resources sector driving the market — nothing to do with our domestic economy, politics, or consumers. It’s simply higher commodity prices, especially gold.

See the resources sector is up 38% year to date? The S&P 500 is up only 2.5% during the same period. The industrials are up 14%, but that’s really just Naspers.

The good news is that our gold mining companies are making a fortune. And why is that good? Because they’ll be paying a fortune in tax.

It’s reminiscent of the 2022 resources boom, when then-Finance Minister Tito Mboweni delivered a budget speech that actually lowered personal income tax rates.

We know the government is currently spending more than it collects. For the record, governments don’t earn; private individuals and businesses earn. Government collects tax.

But in this case, our “family trust,” the resources sector, might just bail us out again. And for that, I’m grateful.

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’