US stocks are currently at all-time highs. That can feel scary. I’ve written before about how investing at all-time highs isn’t as dangerous as it feels — in fact, the odds are often in your favour.

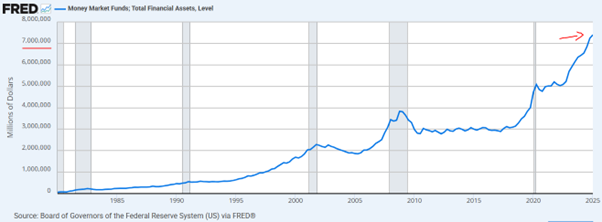

But what I find even more interesting is that cash sitting in US money market funds is also at an all-time high. It jumped massively just before COVID, and has been rising steadily ever since.

Have a look at the chart below. There is currently over $7 trillion sitting on the sidelines. That figure was below $5 trillion just two years ago.

Chart: US Money Market Funds

In other words, there’s a mountain of cash on the sidelines, currently parked in money markets. When interest rates eventually come down - and they will - that money will start seeking higher returns, providing a strong tailwind for equities.

So, how did we get here?

The lockdowns during Covid caused severe blockages in global logistics networks and disrupted supply chains, resulting in stock shortages and, consequently, higher prices of goods.

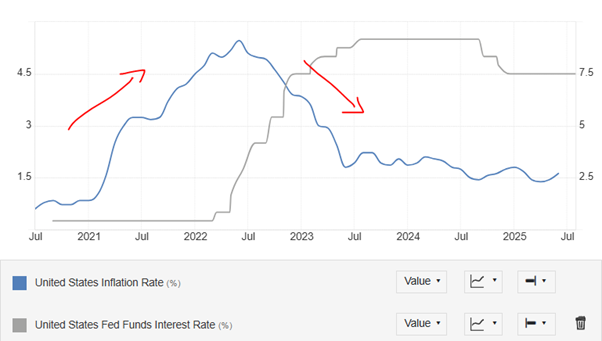

This resulted in rising inflation – see that blue line in the chart below? See how it increases from 2021 -

Chart: US Inflation and Interest rates

Note: Inflation blue line is read off right Y axis; Fed Funds Rte is read off left Y axis

As a result of rising inflation, the US Fed, and central banks around the world, began a campaign of rapid interest rate hikes – have a look at that grey line and how it picks up from virtually 0% to over 7% (read of the right axis).

While these hikes have contained inflation, which is within the target range, the repo rates have remained high.

The concern, however, was that rapid interest rate hikes would have severe negative effects on economies and, by extension, stock markets. As a result, many investors feared a market crash and began hoarding cash. Another factor was that interest rates had risen to their highest levels in years — allowing consumers to lock in 4.5% in USD money markets, compared to just 1% before the hikes.

Thus, the tradeoff in 2022 was either to stay invested in risky markets with an impending crash, or to take your guaranteed ‘safe’ 4.5% in a USD money market.

Well, 2023 is now known as the year of the most widely anticipated recession that never happened. Since then, we’ve seen back-to-back years of 20%+ growth in the US stock market. The JSE has also been on a tear.

Turns out, all those waiting in cash missed out. And many of them are still sitting in cash, waiting for that crash — which is why there’s now $7 trillion on the sidelines.

Looking forward

So, what data has come out this year so far? What do we know about the US consumer? We focus on the US since they are the engine of the global market.

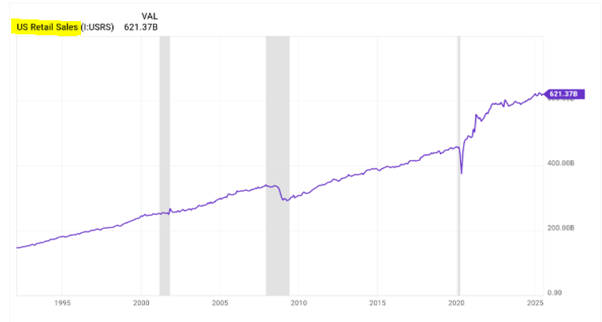

The chart below shows US consumer spending since 1980. Notice how it goes up and to the right? While spending dipped during the Global Financial Crisis (2008) and again in 2020 during COVID, it has more than recovered.

This resilience matters. US consumers are still spending — and that fuels company revenues, which ultimately supports higher share prices.

It’s showing up in the numbers too.

The next chart shows the percentage of US companies beating earnings expectations (i.e. reporting profits above analyst forecasts). As of June 2025, over 80% of companies exceeded expectations — a clear sign that strong consumer demand is translating into stronger-than-expected corporate performance.

Chart: US Earnings Beats

Source: PSG Old Oak, Linkedin

No-wonder US markets are running so hard. It’s already up 8% this year, despite the 20% sell-ff that happening in March from the tariff scare.

But isn’t this all just credit-fueled?

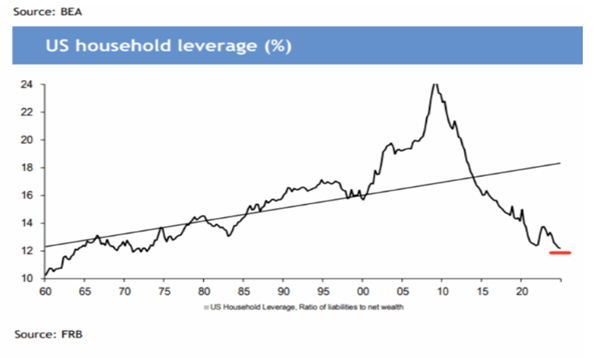

You may argue that higher spending and profits just mean the US consumer is spending money they don’t have. But that’s not what the data says.

US household leverage is at its lowest level in decades. Consumers are spending — but they’re doing so from a position of financial strength. Balance sheets are healthy.

Chart: US Household Leverage

See how leverage peaked in 2008? When the Global Financial Crisis hit, households were overleveraged and vulnerable. Today, that’s not the case. Consumers have learned their lesson.

Yes, the headlines are full of stories about rising prices, housing unaffordability, and financial stress.

But the data tells a different story.

Of course, this doesn’t mean nothing bad can happen. Excesses will build again. That’s how cycles work. People get comfortable, take on more risk, leverage rises, complacency sets in. Too much stability eventually sows the seeds of instability.

And we won’t see the next crash coming. When it does (and it will), it will seem obvious in hindsight. I’m sure we’re sowing the seeds of the next big crash right now, we just don’t know it yet.

All we can do is stay positive, keep investing, and have a plan for when it comes. And whether that’s next year, in five years, or in ten — no one knows.

But having a thoughtful plan that embraces both growth and risk remains your best chance at long-term success.

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’